Credit unions are non-profit organizations offering their members a range of financial products and services, including unsecured credit cards. The status of unsecured credit cards in US credit unions is a crucial aspect of the financial market. This article will provide an update on the latest report on unsecured credit cards in US credit unions as of Q3 2022.

Days Late and Still Accruing

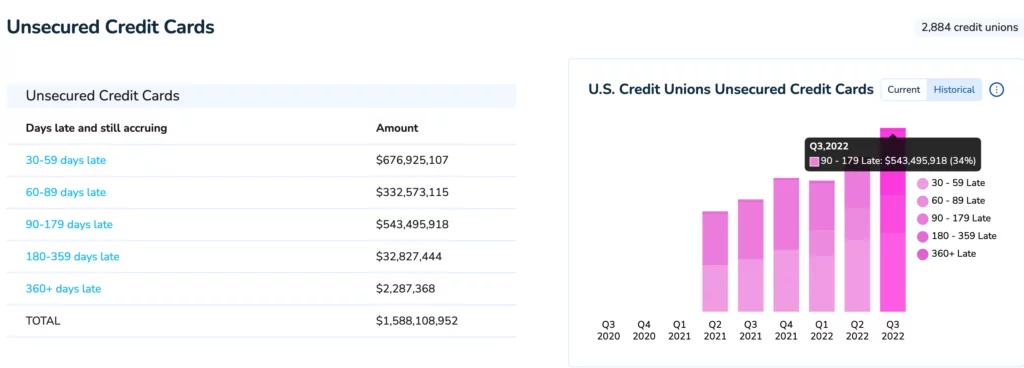

According to the latest report from CUNA (Credit Union National Association), the following is the status of unsecured credit cards in US credit unions as of Q3 2022, which has increased compared to Q2 2022:

- 30-59 days late: $676,925,107

- 60-89 days late: $332,573,115

- 90-179 days late: $543,495,918

- 180-359 days late: $32,827,444

- 360+ days late: $2,287,368

Total: $1,588,108,952

CUNA Report

CUNA, the national association of credit unions, publishes a quarterly report called the Credit Union National Association Call Report. This report provides information on the status of unsecured credit cards in US credit unions and is a valuable resource for investors and those interested in the financial market.

Investing in Unsecured Credit Cards

If you’re interested in investing in unsecured credit cards or learning more, reach out to Fitzgerald Advisors. We are a defaulted debt brokers and mortgage note & REO brokerage firm that specializes in these areas and can provide valuable guidance and advice on the investment process.

Conclusion

Unsecured credit cards in US credit unions are a crucial aspect of the financial market, and the latest report from CUNA provides an update on their status as of Q3 2022. If you’re interested in investing in unsecured credit cards, it’s important to do your due diligence and thoroughly research the market. Working with a specialized brokerage firm like Fitzgerald Advisors can also be a valuable resource in the investment process, providing valuable guidance and advice on acquiring unsecured credit cards.