The status of non-performing auto loans is a critical aspect of the U.S. financial and automotive markets. This article provides a comprehensive overview of non-performing auto loans in the U.S. as of Q4 2022.

Non-Performing Auto Loans in the U.S.

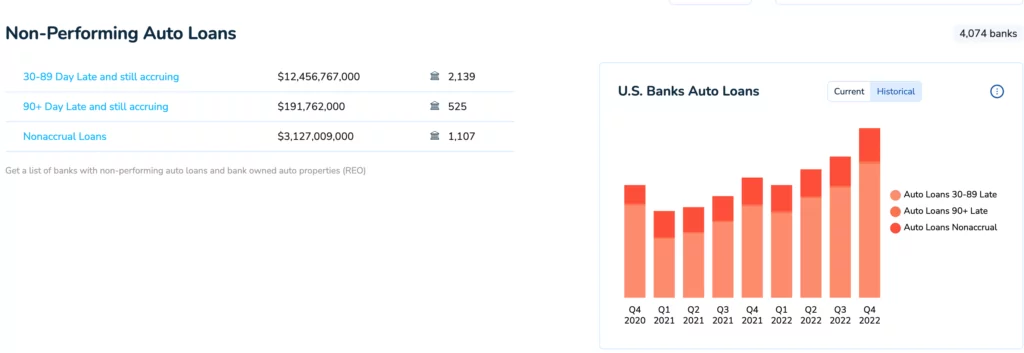

As of the end of Q4 2022, there were 3,371 banks in the U.S. with non-performing auto loans. Auto loans are loans issued to finance the purchase of a vehicle.

30-89 Day Late and still accruing

As of the end of Q4 2022, there were $12,456,767,000 in non-performing auto loans that were 30-89 days late and still accruing, with 2,139 banks holding these loans.

90+ Day Late and still accruing

As of the end of Q4 2022, there were $191,762,000 in non-performing auto loans that were 90+ days late and still accruing, with 525 banks holding these loans.

Nonaccrual Loans

As of the end of Q4 2022, nonaccrual loans for auto properties totaled ,127,009,000, with 1,107 banks holding these loans.

Regulatory Reporting Requirements

The information provided in this article is based on the regulatory financial report required by the Federal Financial Institutions Examination Council (FFIEC) and the Federal Deposit Insurance Corporation (FDIC). Banks must submit quarterly reports to the FDIC and FFIEC on their defaults.

Investing in Non-Performing Auto Loans

If you’re interested in investing in non-performing auto loans, contact Fitzgerald Advisors. We are a mortgage note and non-performing auto loans brokerage firm that specializes in these areas and can provide valuable guidance and advice on the investment process. We can also provide a list of banks with non-performing auto loans and bank-owned auto properties (REO).

Conclusion

Non-performing auto loans are crucial in the U.S. financial and automotive markets. Understanding the current state of these assets is essential for anyone considering investing in them. The information provided in this review is based on the regulatory financial reports required by the FFIEC and FDIC and provides a comprehensive overview of non-performing auto loans in the U.S. as of Q4 2022.

If you’re interested in investing in non-performing auto loans, you must do your due diligence and thoroughly research the market. Working with a specialized brokerage firm like Fitzgerald Advisors can also be a valuable resource in the investment process. With extensive experience in this field, they can provide valuable guidance and advice on acquiring non-performing auto loans.