The status of non-performing business C&I loans is critical to the U.S. financial and commercial markets. This article provides a comprehensive overview of non-performing business C&I loans in the U.S. as of Q4 2022.

Non-Performing Business C&I Loans in the US

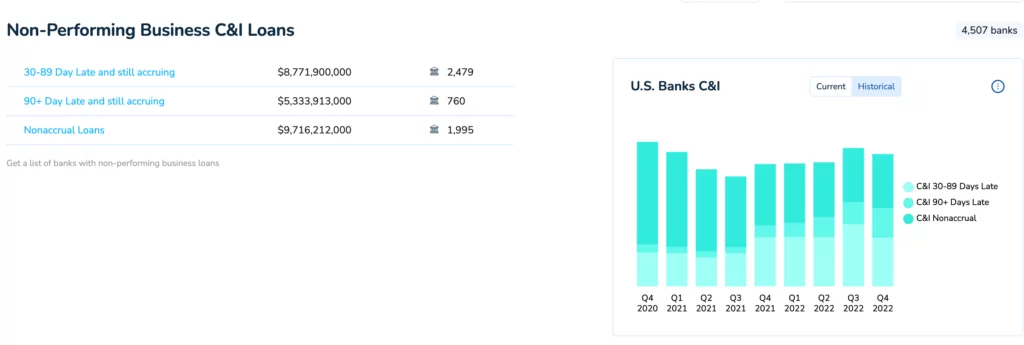

As of the end of Q4 2022, there were 4,507 banks in the U.S. with non-performing business C&I loans. Business C&I loans, also known as commercial and industrial loans, are loans issued to finance the operations and growth of a business.

30-89 Day Late and still accruing

As of the end of Q4 2022, there were $8,771,900,000 in non-performing business C&I loans that were 30-89 days late and still accruing, with 2,479 banks holding these loans.

90+ Day Late and still accruing

As of the end of Q4 2022, there were $5,333,913,000 in non-performing business C&I loans that were 90+ days late and still accruing, with 760 banks holding these loans.

Nonaccrual Loans

As of the end of Q4 2022, nonaccrual loans for business C&I properties totaled ,716,212,000, with 1,995 banks holding these loans.

Regulatory Reporting Requirements

The information provided in this article is based on the regulatory financial report required by the Federal Financial Institutions Examination Council (FFIEC) and the Federal Deposit Insurance Corporation (FDIC). Banks must submit quarterly reports to the FDIC and FFIEC on their defaults.

Investing in Non-Performing Business C&I Loans

If you’re interested in investing in non-performing business C&I loans, contact Fitzgerald Advisors. We are a mortgage note and non-performing business C&I loans brokerage firm that specializes in these areas and can provide valuable guidance and advice on the investment process.

Non-performing business C&I loans are crucial in the U.S. financial and commercial markets. Understanding the current state of these assets is essential for anyone considering investing in them. The information provided in this article is based on the regulatory financial reports required by the FFIEC and FDIC. It provides a comprehensive overview of non-performing business C&I loans in the U.S. as of Q4 2022.

If you’re interested in investing in non-performing business C&I loans, it’s crucial to do your due diligence and research the market thoroughly. Working with a specialized brokerage firm like Fitzgerald Advisors can also be a valuable resource in the investment process. With extensive experience in this field, they can provide valuable guidance and advice on acquiring non-performing business C&I loans.