Bank’s REO & Non-Performing Loans Overview | U.S.

Are you interested in the commercial real estate market in the United States and want to know more about banks with non-performing commercial real estate loans and bank-owned commercial properties (REO)? In this article, we will provide a comprehensive overview of the current state of non-performing commercial real estate loans and REO in the U.S. and provide a list of banks with non-performing commercial real estate loans and REO.

Non-Performing Commercial Real Estate Loans and REO in the U.S.

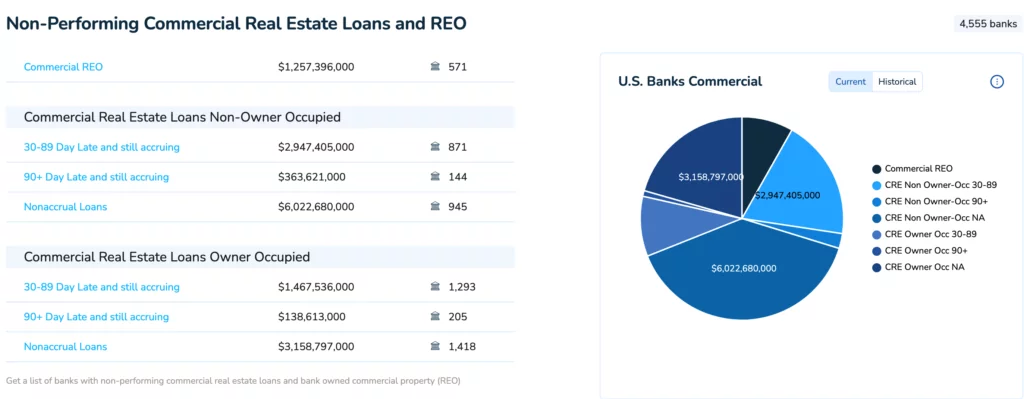

As of the end of 2022, there were 4,555 banks in the U.S. with non-performing commercial real estate loans and REO. Non-performing commercial real estate loans are loans on which the borrower has not made payments for a certain period of time and is at risk of default. REO, on the other hand, are properties that a bank has acquired as a result of a foreclosure and are now owned by the bank.

Commercial Real Estate Loans Non-Owner Occupied

Non-owner-occupied commercial real estate loans make up a significant portion of non-performing commercial real estate loans in the U.S. As of the end of 2022, there were ,947,405,000 in non-owner occupied commercial real estate loans that were 30-89 days late and still accruing, with 871 banks holding these loans. There were also 3,621,000 in non-owner-occupied commercial real estate loans that were 90+ days late and still accruing, with 144 banks holding these loans. Nonaccrual loans, which are loans on which the bank has stopped accruing interest, totaled $6,022,680,000, with 945 banks holding these loans.

Commercial Real Estate Loans Owner Occupied

Owner-occupied commercial real estate loans also have a significant number of non-performing loans in the U.S. As of the end of 2022, there were ,467,536,000 in owner-occupied commercial real estate loans that were 30-89 days late and still accruing, with 1,293 banks holding these loans. There were also 8,613,000 in owner-occupied commercial real estate loans that were 90+ days late and still accruing, with 205 banks holding these loans. Nonaccrual loans for owner-occupied commercial real estate totaled ,158,797,000, with 1,418 banks holding these loans.

Non-performing commercial real estate loans and REO are important U.S. real estate market components. This article provides an overview of non-performing commercial real estate loans and REO in the U.S. and offers information on how to invest in these assets.

NPL & REO Market Overview for Commercial Investors

Investing in non-performing commercial real estate loans and REO can be complex and should only be attempted by experienced investors. Conducting thorough research and due diligence before making any investment decisions is crucial.

One way to invest in non-performing commercial real estate loans and REO is to partner with a mortgage note and REO brokerage firm specializing in these areas. Fitzgerald Advisors is a mortgage note and REO brokerage firm specializing in non-performing commercial real estate loans and REO. They have extensive experience working with investors to help them acquire these assets and provide valuable guidance and advice on the investment process.

Conclusion

Non-performing commercial real estate loans and REO are a crucial part of the U.S. real estate market, with thousands of banks holding these assets. If you are interested in investing in these types of assets, conducting thorough research and due diligence is vital to make informed investment decisions. Working with a specialized brokerage firm like Fitzgerald Advisors can be a valuable resource to guide you through the investment process.