In addition to non-performing commercial real estate loans and REO, non-performing construction loans, and REO are essential to the U.S. real estate market. This review will provide an overview of the current state of non-performing construction loans and REO in the U.S., including a list of banks with non-performing construction loans and REO.

Non-Performing Construction Loans and REO in the U.S.

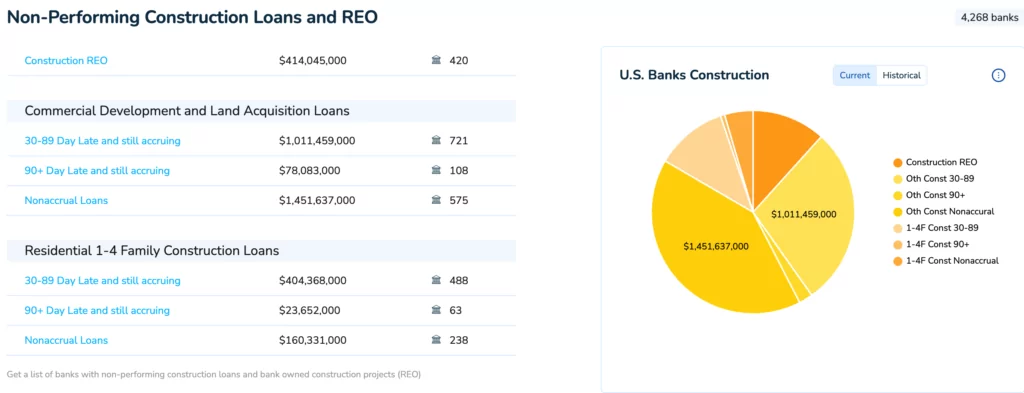

As of the end of 2022, there were 4,268 banks in the U.S. with non-performing construction loans and REO. Non-performing construction loans are loans that have been issued to finance the construction of a property, but the borrower has not made payments for a certain period of time and are at risk of default. On the other hand, REO is properties that a bank has acquired due to foreclosure and are now owned by the bank.

Construction REO

As of the end of 2022, there were $414,045,000 in construction REO, with 420 banks holding these properties. Construction REO can include both completed and partially completed projects, as well as undeveloped land.

Commercial Development and Land Acquisition Loans

Non-performing commercial development and land acquisition loans are loans issued to finance the acquisition of land for commercial development, such as the construction of a shopping center or office building. As of the end of 2022, there were ,011,459,000 in non-performing commercial development and land acquisition loans that were 30-89 days late and still accruing, with 721 banks holding these loans.

There were also ,083,000 in non-performing commercial development and land acquisition loans that were 90+ days late and still accruing, with 108 banks holding these loans. Nonaccrual commercial development and land acquisition loans totaled ,451,637,000, with 575 banks holding these loans.

Residential 1-4 Family Construction Loans

Non-performing residential 1-4 family construction loans are loans issued to finance the construction of residential properties, such as single-family homes or multi-family buildings. As of the end of 2022, there were $404,368,000 in non-performing residential 1-4 family construction loans that were 30-89 days late and still accruing, with 488 banks holding these loans.

There were also $23,652,000 in non-performing residential 1-4 family construction loans that were 90+ days late and still accruing, with 63 banks holding these loans. Nonaccrual loans for residential 1-4 family construction totaled 0,331,000, with 238 banks holding these loans.

Investing in non-performing construction loans and REO can be challenging and requires careful consideration and expertise. If you are interested in investing in these assets, obtaining a list of banks with non-performing construction loans and REO is crucial.

However, it can be difficult to obtain this information, as not all banks publicly disclose this data. Nevertheless, several resources, including online databases and professional networks, can help you access this information.

Investing in Non-Performing Construction Loans and REO

Investing in non-performing construction loans and REO requires in-depth market knowledge and a thorough understanding of the investment process. Conducting extensive research and due diligence is vital to make informed investment decisions.

One way to invest in non-performing construction loans and REO is to collaborate with a mortgage note and REO brokerage firm specializing in these areas. Fitzgerald Advisors is a mortgage note and REO brokerage firm specializing in non-performing loans and REO. They have extensive experience working with investors to help them acquire these assets and provide valuable guidance and advice on the investment process.

Conclusion

Non-performing construction loans and REO are critical to the U.S. real estate market, with thousands of banks holding these assets. If you are interested in investing in these assets, you must do your due diligence and thoroughly research the market. Working with a specialized brokerage firm like Fitzgerald Advisors can also be a valuable resource in the investment process.